ASK Automotive Ltd

Auto Ancillary

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

Multiple levers in place to drive growth for Ask Auto

Company Profile

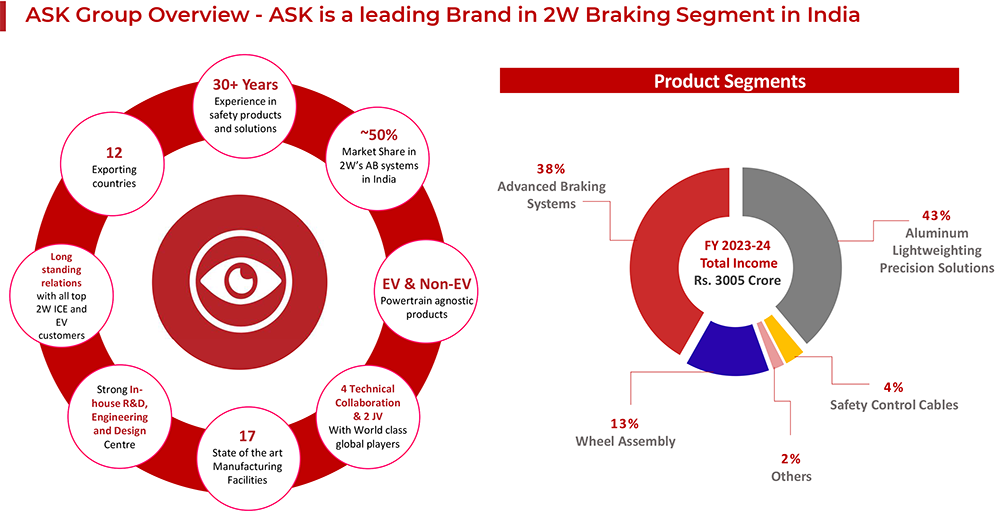

Incorporated in 1988 and based in Manesar, Haryana, ASK Automotive Ltd (AAL) is

the largest manufacturer of Brake-shoe and Advanced AB systems for 2W OEMs in India

with a market share of 50% in FY24 by production volume. ASK Automotive Limited

has supplied safety systems and critical engineering solutions for over three decades

with in-house designing, developing, and manufacturing capabilities. Ask has also

emerged as a sizeable player in Aluminum Light-weighting products and 2W Safety

Control Cables where it is gaining market share. The company supplies AB systems,

ALP solutions, wheel assembly, and SCC products to automotive OEMs (2W, 3W, PV,

and CV) and non-automotive OEMs (ATV, power tools, and outdoor equipment). ASK’s

product offerings include (i) Advanced Braking systems; (ii) aluminum light weighting

precision (“ALP”) solutions, (iii) wheel assembly to 2W OEMs; and (iv)

safety control cables (“SCC”) products that are powertrain agnostic,

catering to EV as well as internal combustion engine OEMs. It has 4 technical collaborations

and 2 joint ventures with leading global players.

They operate 17 manufacturing facilities and are setting up an 18th manufacturing facility in Bengaluru with an investment of Rs.200 cr to cater to Southern customers. It is expected to be operational in Q4FY25. The Company supplies its products to all of the top six 2W OEMs in India, the largest motorized 2W market in the world.

Ask Automobile Pvt Ltd. (AAPL) is a wholly-owned subsidiary of AAL and was incorporated in June 2021. It has recently set up manufacturing plants at Bhiwadi in Rajasthan and in Bengaluru for manufacturing auto components and parts. The new facilities became operational in April 2024.

Investment Arguments

Well-established manufacturer of safety systems and critical engineering solutions

for some of India’s largest original equipment manufacturers (“OEMs”)

ASK is the largest manufacturer of Brake-shoe and Automotive Braking (AB) systems

(primarily Drum Braking systems) for 2Ws (two-wheelers) in India with a share of

~50% in terms of production volume for original equipment manufacturers (OEMs) +

branded independent aftermarket segment. The company is also prominent in Safety

Control Cable (SCC) products and Aluminium Light-Weighting Precision (ALP) solutions.

Presence in the overseas markets and aftermarket segment, and diversified product

mix including brake shoes, aluminium die castings, and panel assemblies, support

the market position. The company has focused on increasing its presence in the 3W,

PV, and CV sectors. It currently supplies products to a PV manufacturer in the small

car segment in India, among other OEMs in the automotive sector.

Diverse and extensive product portfolio

ASK has a comprehensive portfolio of EV and powertrain-agnostic products and as

of March 31, 2024 they were supplying safety systems and critical engineering solutions

to nine 2W EV OEMs in India. In addition, they are developing capabilities for product

migration from steel and plastics to Aluminium, for lightweight and thermal management

for e-powertrain and e-powertrain products. It also develops and supplies select

ALP solutions for a wide range of non-automotive applications. In the last few years,

the company has successfully demonstrated its capabilities by adding new ALP components

specifically for EV programs. This includes components such as e-powertrain pulleys,

battery pack housing, electric motor housing, ECU heat sink, etc. This has expanded

its ALP kit value for E2W by 2x vs. that of an ICE 2W. Further, the company is working

on ~20 new programmes for E2W OEMs, which is expected to further increase its content

per vehicle.

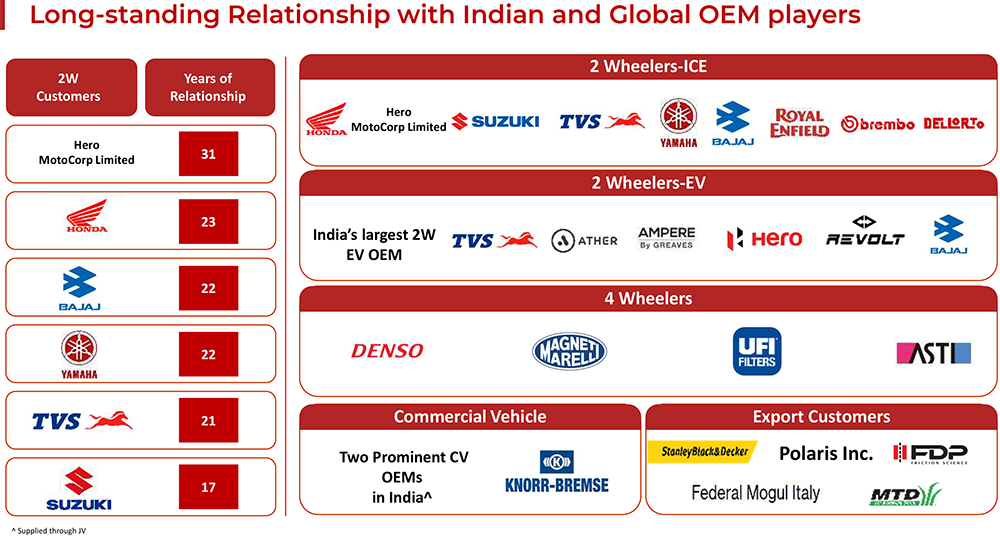

Long-standing relationship with Indian and global OEM players

The company has established healthy relationships with Indian and global OEM players

owing to experience in developing complex critical safety systems and solutions.

Globally, its customers include Stanley Black & Decker, Polaris, Federal mogul

Italy and MTD products. In India, its customers include the top six 2W OEMs (in

terms of production volume and value for Fiscal 2024). They have been serving each

of the top six 2W OEMs in India for more than 16 years as of March 31, 2024. They

have been successful in developing customer relationships and supplying EV-based

2W OEMs in India such as TVS, Ather, Hero MotoCorp, Greaves, Bajaj, and Revolt.

Given the safety and precision engineering aspect of its products, they are involved at the early stage development of vehicle models by its customers. Furthermore, their design and R&D capabilities have contributed towards the building of these long-standing relationships. Their ability to work closely with customers, providing them with safety systems and customized critical engineering solutions, and extensive experience in manufacturing precision and lightweight products have contributed to long-standing relationships with key 2W OEMs in India. Furthermore, it has demonstrated track record of value addition and value engineering capabilities, helping its customers in import substitution i.e, encouraging production in the domestic markets to limit the extent of imports). They intend to diversify and expand its business operations in accordance with the evolving needs of customers and intend to leverage long-standing relationship with such market players allowing them to leverage industry tailwinds in the automotive sector.

New products to drive healthy growth in the medium term

ASK has a track record of consistently adding new products (for example: safety

control cables, and now alloy wheels) and customized solutions (especially in ALP

solutions). During the last 6 months, the company has likely rolled out products

and solutions for 45 programmes for the automotive industry and nine programmes

for the non-automotive industry. The ramp-up of these programmes is expected to

drive strong growth in the medium term. Further, the company has recently entered

into a strategic partnership with LIOHO Machine Works, Taiwan, for technical assistance

to design, develop, and manufacture high-pressure die-casted 2W alloy wheels to

cater to both its existing and new customers. The production of alloy wheels is

targeted to begin in Q4FY25. This is expected to further expand ASK’s kit

value in 2Ws and drive healthy growth going ahead.

Prominent Player in 2W EV Segment to Capture Growing Electrification Trend

ASK has emerged as a prominent player in the 2W EV segment in order to capture the

growing shift to EV trends. The company has a robust pipeline of new products for

EV OEMs. Diverse EV product offerings include Belt cover Front, Hub rear, Pulley,

rear grip, EV motor, structural arm, side stand, battery pack etc. The company’s

key clientele in 2W EV OEM includes TVS, Hero MotoCorp, Revolt, Bajaj, Ampere, and

Ather. With the increasing adoption of electrification, there's a heightened

focus on light-weighting, driving higher aluminium content in a vehicle. Focus on

EV penetration is likely to strengthen ASK’s position and drive higher content

per vehicle.

Leverage export opportunities and focus on new markets

ASK exports aluminium light-weighting products in automotive and non-automotive

segments across 12+ countries. ASK’s focus is on expanding its global presence

(enter new markets) by leveraging its existing relationships with customers outside

India. Further, through its joint venture with ASK Fras-Le (49% share held by ASK),

it supplies advanced braking products to the global aftermarket segment for CVs.

FRAS-LE is a global producer of brake pads and brake linings for CVs. ASK has granted

an exclusive licence to ASK Fras-Le to use formulations for CV products including

trademarks, intellectual property, technical knowledge, technology, engineering

data, blueprints, etc. JV ASK FRAS-LE supplies AB products like brake pads and brake

linings from 3.5 tonnes and above to global and Indian aftermarket for CVs, and

to Indian CV OEMs.

Q2FY25 Financial Performance

Ask Automotive reported highest ever revenue and PAT in Q2FY25 driven by strong

growth across all three business verticals. Consolidated net sales rose 23% YoY

to Rs.974 cr as compared to Rs.794 cr in the same quarter of preceding fiscal. The

company continued to outperform the two-wheeler industry vehicle production growth

in Q2FY25. Further, EBITDA margins have crossed 12% level. The company delivered

EBITDA margins of 12.2% in Q2FY25, which is 230 basis points higher than Q2 FY24

and 20 basis points higher than Q1 FY25. As a result of strong performance in Q2

FY25, revenue has grown by 26%, EBITDA by 55% and PAT by 63% in H1 FY25 on year-on-year

basis. EBITDA margins stood at 12.1% in H1 FY25 with an improvement of 220 basis

points on year-on-year basis. These strong results reflect the result of continued

focus on expanding value-added businesses, improving utilization of production capacities

and bringing cost efficiencies. The EBITDA margin improvement was on account of

Higher Volume driven economies of scale, Capacity utilization of Karoli facility

and Focus on cost optimization initiatives. PAT surged 63% YoY to Rs.67 cr.

All the three product segments continue to perform well and deliver robust revenue growth in Q2 FY25. We have sustained market leadership position in the advanced braking system business with 18% year-on-year growth. The aluminium light weighting precision solutions, largest business segment with 45% share of revenue, leaded the growth momentum and delivered 27% year-on-year growth. And safety control cables also grew by a healthy 18% on year-on-year basis. They have recorded strong growth in margins and profitability. Q2FY25 EBITDA stood at Rs.119 crore recording 50% year-on-year growth and H1 FY25 at INR 222 crore hosting 55% year-on-year growth. It delivered PAT of Rs.67 crore with 63% year-on-year growth in Q2 FY25 and Rs.124 crore in H1 FY25 with 63% growth on year-on-year basis.

Key Conference call takeaways

- The mega manufacturing facility at Karoli is expanding, with positive EBITDA margins now being generated.

- Construction of a new plant in Bengaluru is on schedule for operationalization in Q4 FY25.

- A solar power plant of 9.9 megawatts in Sirsa, Haryana, is nearing completion for captive consumption.

- Management is optimistic about maintaining growth momentum in the two-wheeler sector, especially during the festive season.

- The company aims to sustain EBITDA margins and gradually improve them in subsequent quarters.

- The Karoli plant has reached 45%-50% capacity utilization, contributing to improved margins.

- Management indicated that commodity price fluctuations are hedged, ensuring no adverse impact on margins.

- The JV with AISIN Group is expected to commence operations in Q4 FY25, with a projected revenue potential of INR 100 crore to INR 150 crore per annum over the next three to five years.

- The alloy wheels business is progressing steadily, with the Bangalore plant expected to commence operations in Q4 FY25.

- A new order worth over INR 75 crore is anticipated from Europe, expected to start in January next year.

Key Risks & Concerns

Revenue concentration in the 2W segment - ASK’s business is heavily dependent on the performance of the 2W segment in India. More than 80% of revenue from operations is dependent on the Indian 2W segment. Any slowdown in the 2W segment could adversely impact business, results of operations and financial condition.

High dependence on HMSI - Revenue contribution from HMSI is ~35%. Any loss in market share for HMSI vs. other 2W OEMs may impact ASK’s outperformance vis-à-vis industry. However, with increase in wallet share with existing customers and addition of new customers, dependence on HMSI is gradually reducing.

Volatility in raw material prices – Any significant increase in key raw material prices could adversely affect company’s operating margins and thus, profitability of the company.

Outlook & Valuation

ASK Automotive Limited is a well-established player in the automotive industry as they are the largest manufacturer of brake-shoe and advanced braking systems for two wheeler in India with a market share of 50% in FY2024. The company has emerged as a sizeable player in aluminium light-weighting components (ALP) and safety control cables (SCC) for the 2W segment, where it is gaining market share. Ask Automotive has consistently outperformed the underlying 2W industry driven by expansion of the product portfolio, addition of new customers and increase in wallet share with existing customers. Backed by a) rising kit value in the ALP segment as the 2W/3W industry transitions to EVs, b) ramp-up of the 2W SCC business, and c) expansion into PV and non-automotive segments by leveraging its capabilities, ASK is well positioned to deliver healthy growth momentum in the coming quarters.

Further, we believe that stock has multiple levers for growth considering its leadership position in safety systems and critical engineering solutions for India’s largest OEMs, robust production model, driven by R&D and design, technology and innovation driven manufacturing process, healthy relationship with marquee customers, consistent financial performance, superior return ratios and steady track record of growth. We believe growth will be driven by 2W/3W electrification and strong momentum in non-auto exports. At a CMP of Rs.445, the stock is trading at 27x FY26E. We recommend a BUY rating on the stock.