APL Apollo Tubes Ltd

Pipes - Metal

Stock Info

Shareholding Pattern

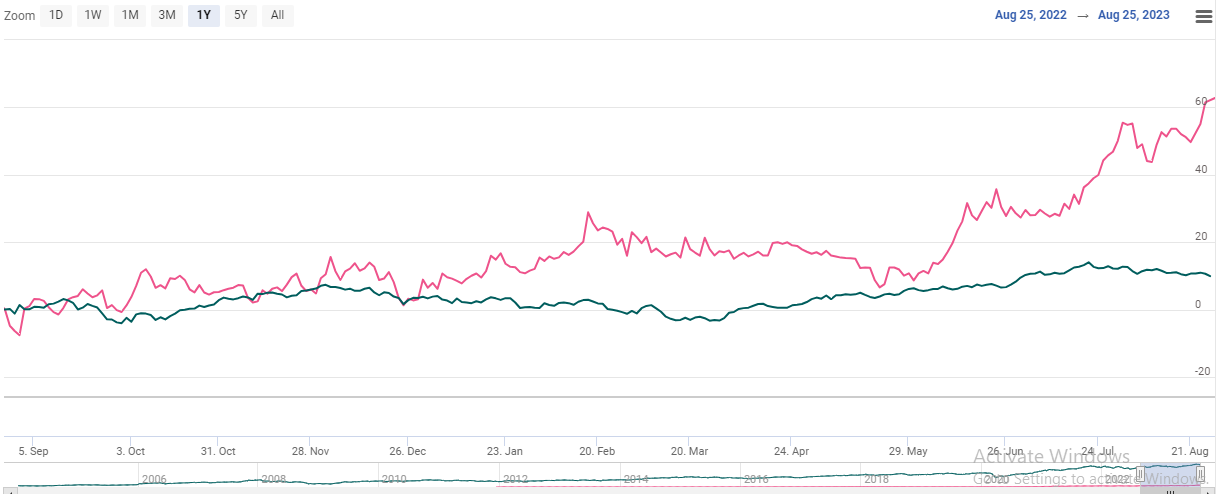

Price performance

Indexed Stock Performance

Product Innovation And Expansions To Drive Future Growth

Company Profile

APL Apollo Tubes Ltd., (AATL) was incorporated in in February 1986 as Bihar Tubes Private Limited with its headquarters in Delhi-NCR. The company is a well established player under ERW Pipes manufacturing industry. It operates through 11 manufacturing facilities across India with a total existing installed capacity of 3.6MnT. The value added products contribute 70% to the overall capacity in Q1 FY24. The robust product basket of the company offers 1100+ product varieties for structural steel applications. These products find there application across urban infrastructure and real estate, rural housing, commercial construction, greenhouse structures and engineering applications.

Investment Rationale

· Well established player in ERW Pipes manufacturing industry

The company has been a well established player in the ERW Pipes manufacturing industry with a ~55% share in the market. Over the years it has expanded its manufacturing capacity to 3.6 million tonnes with 11 manufacturing facilities across India. The company has a huge dealer and distribution network of more than 800 dealer distributors and over 50,000 retailers over the years.

· Multiple product offerings

In Q1 FY24 the sales volume was at 662K tons, an increase of 56% on YoY basis. The company witnessed sales volume recovery with 30% growth despite challenging market conditions. The application mix in Q1 FY24 was Housing~ 50%, Commercial buildings~ 25%, Infrastructure~ 20% and others~ 5%.

The company has also received orders from government agencies and builders for tanks that would be converted to tubes expected to create a 1 million ton market. Additionally, the company has received approval for its tubular design for a railway station in South India and is in touch with at least 20 contractors for orders.

· Product innovation and Expansions to drive future growth

The company plans to expand its capacity in Dubai, East India, and Raipur, with a target of 5 million tons by FY25. AATL plans to aggressively expand in international markets, with a focus on the UAE markets on account of availability of raw materials at cheaper rates and easy accessibility. The company plans to set up a 300,000-tonne plant in Dubai, which will commence by Q4 of FY24, and will target 200,000 tons over the next 3-4 years.

Under product innovation the company is optimistic about the growth of all the three products high diameter tubes, color-coded tubes, and coated products and as per management the performance may start reflecting in next 3-4 months.

· Capex investments worth Rs 500-Rs 600 crores

AATL has plans to spend Rs 500-Rs 600 crores over the span of next 12-18 months to reach 5 million tons capacity, which will be 100% funded from internal cash flows. This capacity expansion will enable the company to preserve its dominant position in the industry among other well established players like TATA Steel and JSW Steels. The company anticipates to go debt-free by FY24 to FY25, funded by operating cash flows and residual capex.

Q1 FY24 Financial Analysis

For the quarter ended 30TH June 2023, the revenue of the company is at Rs 4545 crores, increased by 32% on YoY basis. EBITDA for the quarter was at Rs 307 crores, increased by 58% on YoY basis. EBITDA margins of the company are at 7%, increased by 100 bps as compared to the corresponding quarter of the previous year (Q1 FY23). PAT for the year is at Rs 194 crores, an increase of 60% on YoY basis.

Risk & Concerns

· Intense competition across industry

The company operates in a very competitive industry where it faces competition from both organised and unorganized players. There are various well established players in the industry to name a few Surya Roshni, Tata Steel, Jindal Pipes, Welspun Corp. etc.

· Volatility in steel prices: A sudden fall in steel prices resulting in inventory losses which will affect margins.

Outlook & Valuation

The company is expected to benefit in sales volume growth over the years on account of capacity expansions in domestic and international businesses and with a special focus on UAE markets. Growth under these markets will help the company in increasing its sales revenue and operational margins, since demand traction is high and raw materials are available at cheap rates with ease to accessibility.

Through government tenders company is planning to venture into railway redevelopment projects which will help the company to boost its revenue base. Overall we believe, the growth for coming years is promising and company also plans to go debt free by FY24-FY25, which will further enhance its profitability.

At CMP of Rs 1678, the stock is trading at PE of 36x its FY25E earnings. We recommend ‘BUY’ rating to the stock.