AMI Organics Ltd

Little Masters

Rs. 1177.70

Reco. Date: May 08, 2025

-

Rating: Buy

-

BSE Code: 543349

-

NSE Symbol: AMIORG

Stock Info

- Face Value (Rs) 5

- Equity Capital (Rs cr) 41

- Mkt Cap (Rs cr) 9,390.77

- 52w H/L (Rs) 1322.00 - 504.00

- Avg Daily Vol (BSE+NSE) 132,139

Shareholding Pattern

- (as on 31-Mar) %

- Promoter 35.96

- FIIs 16.48

- DIIs 18.31

- Public & Others 29.23

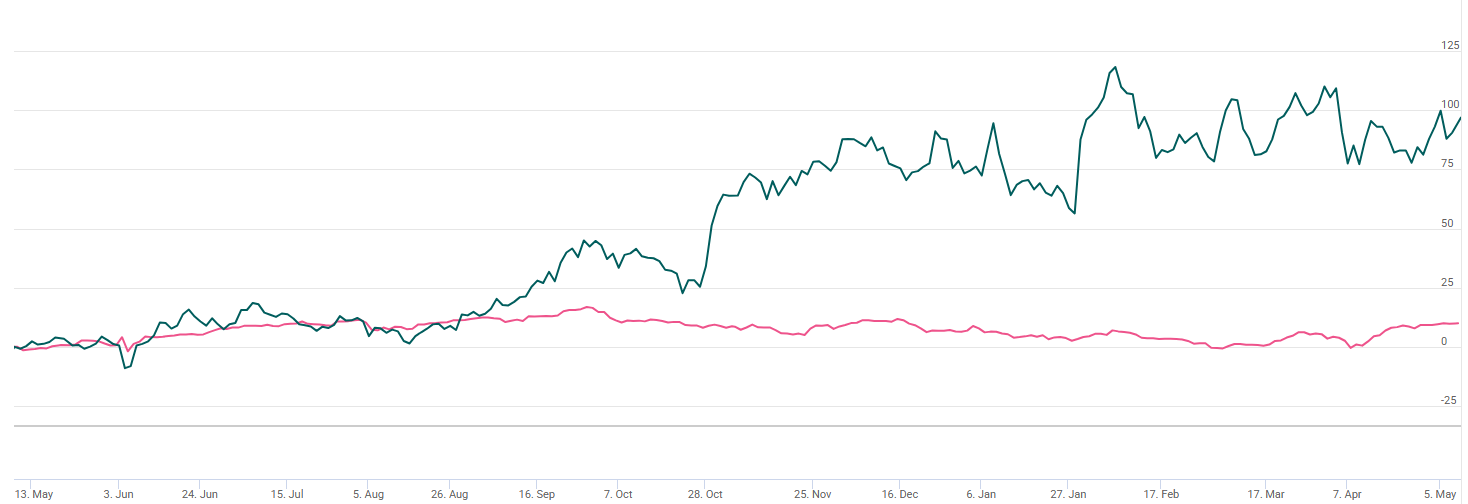

Price Performance

- Return (%) 1m 3m 12m

- Absolute 7.14 -8.05 97.83

- Sensex 10.40 3.71 9.84

Indexed Stock Performance

AMI Organics Ltd Sensex

Data Source: Ace equity, stockaxis Research

AMI Organics Ltd

Strong pipeline of CDMO projects positions the company favorably for sustained long term growth

Company Profile Incorporated in 2004 as a partnership firm, Ami Organics Ltd (AOL) is engaged in the manufacturing of advanced pharmaceutical intermediates and specialty chemicals. Under its advanced pharmaceutical intermediates segment, it manufactures molecules that are under clinical trial, or which have been launched in the patented as well as generic market. It also manufactures specialty chemicals having end-usage in cosmetics, food and personal care, dye, and polymer industries, among others. It is one of the leading research and development (“R&D”) driven manufacturers of specialty chemicals with varied end usage, focused on the development and manufacturing of advanced pharmaceutical intermediates for regulated and generic active pharmaceutical ingredients and New Chemical Entities.

Ami Organics is one of the major manufacturers of Pharma Intermediates for certain key APIs, including Dolutegravir, Trazodone, Entacapone, Nintedanib and Rivaroxaban. The Pharma Intermediates which they manufacture, find application in certain high-growth therapeutic areas including anti-retroviral, anti-inflammatory, anti-psychotic, anti-cancer, anti-Parkinson, anti-depressant and anti-coagulant, commanding significant market share both in India and globally.

Investment Arguments

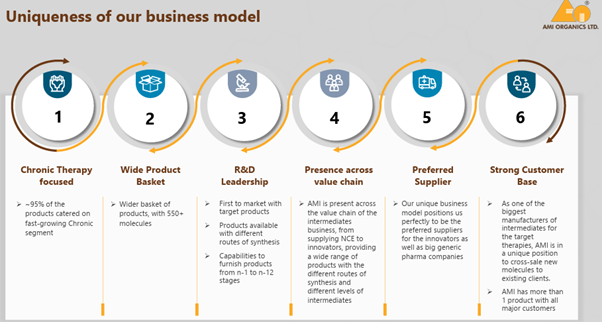

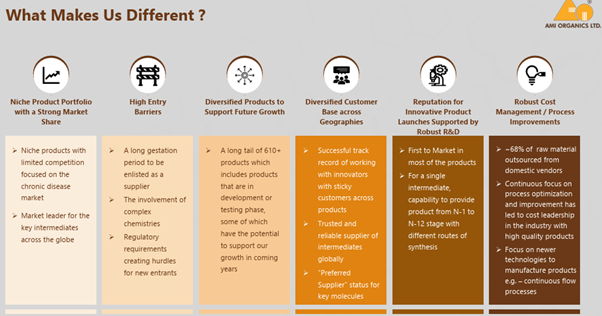

Strong product portfolio with diversification through organic and inorganic routes AOL has an established market position in the advanced pharmaceutical intermediates and specialty chemical business, supported by a strong product portfolio. It has a wide product portfolio, with no product forming more than 10-15% of the total sales. Also, its product composition varies as per the market needs and the introduction of new products. AOL is a preferred supplier for various pharmaceutical intermediates and holds high market shares in certain key molecules.

The company’s advanced pharma intermediates segment contributes around 84% to the company’s net sales and caters to the requirements of APIs and new chemical entities (NCEs) in more than 20 high-growth therapeutic segments such as anti-retroviral, anti-inflammatory, anti-psychotic, anti-cancer, anti-Parkinson, anti-depressant, and anti-coagulant, among others, with over 95% of the revenue derived from chronic segments. GOL had a wide product portfolio, which included specialty chemicals which has applications in preservatives, personal care, pharmaceuticals and resin industries, among others. Post acquisition of the facilities of GOL, AOL also added products catering to the agro-chemicals and paint (UV coating) industries. Apart from the above, AOL has also developed two electrolyte additives for lithium-ion batteries used in energy storage devices. And, as articulated by the management, the company is in the advanced stages of negotiation of contracts with a few customers.

Widespread geographical presence and diversified customer base AOL benefits from its geographically diversified clientele spread across Europe, China, Japan, the UK, Latin America, and the US, among others. Exports contributed around 74% to its net sales during FY25. AOL has a reputed clientele base, with revenue from the top 10 customers constituting 56.8% of its sales for FY25. Furthermore, a few of its customers have been associated with AOL for the past 10 years. We believe that the ability of the company to address the diverse needs of the end-users and adherence to the stringent requirements enables it to secure repeat and additional business from its existing clients as well as to add new clients in an industry having high entry barriers.

High entry barriers in the chemicals manufacturing industry The company manufactures and market advanced pharmaceutical intermediates used for manufacturing of APIs and NCEs in select therapeutic areas such as anti-retroviral, anti-inflammatory, anti-psychotic, anti-cancer, anti-Parkinson, anti-depressant and anti-coagulant. This pharmaceutical intermediates business has high entry barriers inter alia due to: (a) a long gestation period to be enlisted as a supplier with the customers, particularly with the customers in US and European countries, which requires suppliers to adhere to strict compliance requirements, leading to a high regulatory gestation period; and (b) the involvement of complex chemistries in the manufacturing process, which is difficult to commercialize on a large scale.

Q4FY25 Result Highlights AMI Organics showcased robust financial performance for the quarter ended Q4FY25. Consolidated net sales rose 37% YoY to Rs.308 cr as compared to Rs.225 cr registered in the same quarter of preceding fiscal driven by healthy growth in the pharma intermediate sales which jumped to Rs.270 cr (up 14% QoQ and 44% YoY). This jump could be due to a jump in CDMO sales to Fermion. Specialty chemicals revenue fell slightly to Rs. 36 cr and Rs.36 cr in Q3FY25, down 1% QoQ while up 1% YoY). In Q4FY25, pharma intermediate EBITDA margin was 24.5% and speciality chemicals margin was 14.7%. The gross margin for the quarter improved to 47.3% up 734 bps YoY and 108 bps QoQ. On the operational front, consolidated EBITDA witnessed remarkable growth of 97% YoY to Rs.85 cr while EBITDA margin for the quarter was at 27.5% on account of a sharp jump in CDMO sales and resultant positive operating leverage. PAT registered a staggering growth of 144% to Rs.63 cr.

Key Conference call takeaways

Guidance

- Management has guided for a 25% revenue growth in FY26. This is set to be driven by continued growth in the CDMO business, improvement in sales of generic molecules aided by several patent expirations in CY25 and CY26 and electrolyte additives production from H2FY26.

- The company also highlighted that due to the nature of the company’s business cycle, Q1 could be the weakest quarter with top line steadily increasing sequentially till Q4, which is always the strongest quarter. As a result, H1FY26 might appear softer with 40% top line contribution while the remaining 60% for the year will come in H2FY26.

- The management believes that EBITDA margin will improve in FY26 (compared to FY25). In FY25, EBITDA margin for the advanced pharma intermediate was 24.5% while specialty chemicals EBITDA margin was 14.7%; blended total EBITDA margin was ~23%. The specialty chemicals segment margin is expected to be at the current level in FY26.

- The company has also guided for Rs.1000 cr CDMO sales by FY28. – The management said it was seeing increasing enquiries in the CDMO space with India being a viable alternative to China. It added that commercialization of a new CDMO contract remains on track with the company in the qualification stage with the customer. Also, revenue contribution from this new CDMO contract is expected from 2HFY26.

Capex The management has indicated a capex of Rs.200 cr for FY26, comprising spillover capex of Rs.130 cr for electrolyte additives and the rest for maintenance and a pilot plant at Sachin. This will be fully funded through QIP proceeds and internal accruals. Capex for FY25 stood at Rs.195 cr primarily for the Ankleshwar facility, solar plant and electrolyte additives capacity. Block 1 at Ankleshwar is set to be commissioned in Q1FY26 with a 10.8MW solar plant already commissioned at the Sachin facility.

Other Key Highlights

- The company said its generic business has been growing at a good pace and further growth is expected in FY26. This is set to be driven by expiration of patents for several molecules in CY25 and CY26.

- The company said commodity volume, including that of paraben and salicylic acid, in specialty chemicals saw 25% YoY growth in FY25. It expects similar growth in the business in FY26.

- The company said it is on track to complete the electrolyte additives capex at Jhagadia in H1FY26 with production expected to start in 2HFY26. It plans to gradually ramp up operations to reach optimum utilization in 3 years.

- The company is planning to set up a pilot plant at Sachin, which will enable it to expedite scale-up of new products from R&D as well as manufacture new products under the CRAMS model.

- The company added 6-8 customers for Baba Fine Chem.

Key Risks & Concerns

- Risk related to volatile raw material prices and foreign exchange rates: Raw material cost remains the major cost component for the company. This exposes the company to any sharp volatility in raw material prices. In export sales, AOL witnesses price revision on a quarterly basis considering the prices of the key starting material (KSM) and forex rates, while the domestic sale is on a spot basis. This mitigates the price volatility risk to a certain extent.

- Inherent regulatory risk: AOL is exposed to regulatory risk, since the players in the pharmaceuticals industry need to manufacture products that meet the set quality standards of various regulators across the globe as well as the customer requirements. Furthermore, the pharmaceuticals industry is highly regulated and requires various approvals, licenses, registrations, and permissions for business activities.

- Competitive nature of industry: The Company operates in a competitive environment and failure to compete effectively may have a bearing on the company’s financial performance.

Outlook & valuation

Ami Organics delivered an impressive set of earnings for the quarter ended Q4FY25. We like the company given its wide product portfolio in pharmaceutical intermediates, diversification efforts into other specialty chemical spaces, strong client relations across geographies, and robust financials. It is well placed to tap the opportunity in the fast-growing specialty chemical market by leveraging its strong R&D capabilities and expanding its product portfolio. We believe that the near to medium-term growth would be driven by advanced intermediates for pharma innovators. AMI is present across the value chain of the intermediates business, from supplying NCE to innovators, to providing a wide range of products with different routes of synthesis and different levels of intermediates. As one of the biggest manufacturers of intermediates for the target therapies, AMI is in a unique position to cross-sale new molecules to existing clients. Their unique business model positions them perfectly to be the preferred suppliers for innovators as well as big generic pharma companies. The company is gradually executing Fermion’s contract in the first block of the Ankleshwar unit. It is meant for advanced pharmaceutical intermediates for the API Darolutamide and would finally ramp up in FY26. Hence, we believe Ami Organics is well-placed to capitalize on domestic and global opportunities.

We believe that the pipeline of CDMO projects is progressing well, with several initiatives nearing commercialization by FY26, positioning the company favourably for sustained long-term growth. Management has guided for 25% growth for FY26. Strong sales from Fermion contracts, the commercialization of an additional CDMO contract, significant expansion in the generic intermediate portfolio, and contributions from electrolyte additives projected from FY26E are some growth drivers for the company. We believe that the near-term growth would be driven by the advanced intermediates business. Operating margins are expected to improve further in FY26 due to operating leverage and also due to energy cost savings, following the setting up of a captive solar plant. At CMP of Rs.1161.80, the stock is trading at 33x FY27E. We recommend BUY rating on the stock.