AMI Organics Ltd

Pharmaceuticals & Drugs

Stock Info

Shareholding Pattern

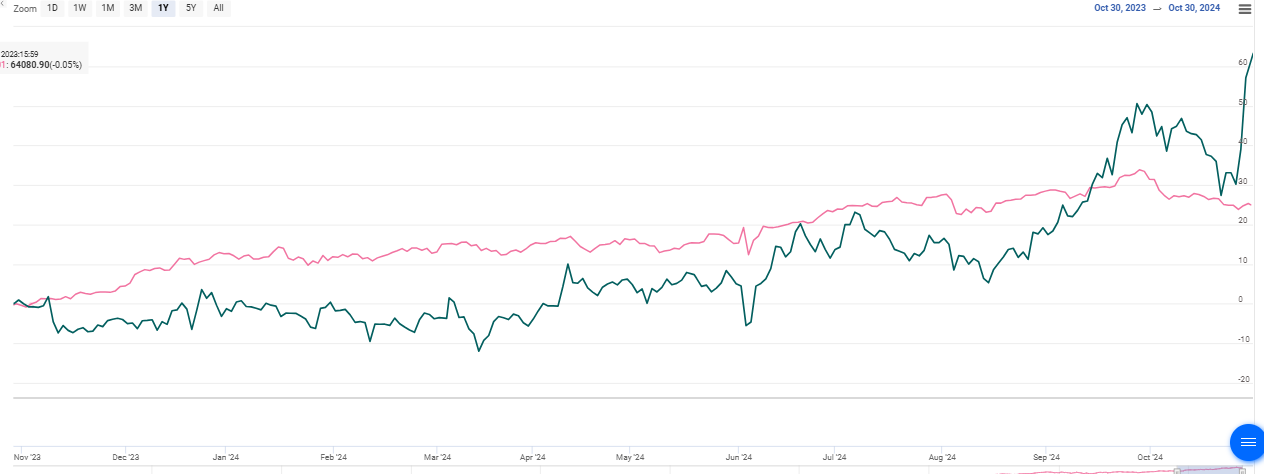

Price performance

Indexed Stock Performance

Ami Organics - Diversified Pharma cum Specialty Chemical Play

Company Profile

Incorporated in 2004 as a partnership firm, Ami Organics Ltd (AOL) is engaged in

the manufacturing of advanced pharmaceutical intermediates and specialty chemicals.

Under its advanced pharmaceutical intermediates segment, it manufactures molecules

that are under clinical trial, or which have been launched in the patented as well

as generic market. It also manufactures specialty chemicals having end-usage in

cosmetics, food and personal care, dye, and polymer industries, among others. It

is one of the leading research and development (“R&D”) driven manufacturers

of specialty chemicals with varied end usage, focused towards the development and

manufacturing of advanced pharmaceutical intermediates for regulated and generic

active pharmaceutical ingredients and New Chemical Entities.

Ami Organics is one of the major manufacturers of Pharma Intermediates for certain key APIs, including Dolutegravir, Trazodone, Entacapone, Nintedanib and Rivaroxaban. The Pharma Intermediates which they manufacture, find application in certain high-growth therapeutic areas including anti-retroviral, anti-inflammatory, anti-psychotic, anti-cancer, anti-Parkinson, anti-depressant and anti-coagulant, commanding significant market share both in India and globally.

Investment Arguments

Strong product portfolio with diversification through organic and inorganic routes

AOL has an established market position in the advanced pharmaceutical intermediates

and specialty chemical business, supported by a strong product portfolio. It has

a wide product portfolio, with no product forming more than 10-15% of the total

sales. Also, its product composition varies as per the market needs and the introduction

of new products. AOL is a preferred supplier for various pharmaceutical intermediates

and holds high market shares in certain key molecules.

The company’s advanced pharma intermediates segment contributes around 84% to the company’s net sales and caters to the requirements of APIs and new chemical entities (NCEs) in more than 20 high-growth therapeutic segments such as anti-retroviral, anti-inflammatory, anti-psychotic, anti-cancer, anti-Parkinson, anti-depressant, and anti-coagulant, among others, with over 95% of the revenue derived from chronic segments. GOL had a wide product portfolio, which included specialty chemicals which has applications in preservatives, personal care, pharmaceuticals and resin industries, among others. Post acquisition of the facilities of GOL, AOL also added products catering to the agro-chemicals and paint (UV coating) industries. Apart from the above, AOL has also developed two electrolyte additives for lithium-ion batteries used in energy storage devices. And, as articulated by the management, the company is in the advanced stages of negotiation of contracts with a few customers.

Widespread geographical presence and diversified customer base

AOL benefits from its geographically diversified clientele spread across Europe,

China, Japan, the UK, Latin America, and the US, among others. Exports contributed

around 56% to its net sales during FY24. AOL has a reputed clientele base, with

revenue from the top 10 customers calculating to 56.8% of its sales for FY24. Furthermore,

a few of its customers have been associated with AOL for the past 10 years. We believe

that the ability of the company to address the diverse needs of the end-users and

adherence to the stringent requirements enables it to secure repeat and additional

business from its existing clients as well as to add new clients in an industry

having high entry barriers.

High entry barriers in the chemicals manufacturing industry

The company manufactures and market advanced pharmaceutical intermediates used for

manufacturing of APIs and NCEs in select therapeutic areas such as anti-retroviral,

anti-inflammatory, anti-psychotic, anti-cancer, anti-Parkinson, anti-depressant

and anti-coagulant. This pharmaceutical intermediates business has high entry barriers

inter alia due to: (a) a long gestation period to be enlisted as a supplier with

the customers, particularly with the customers in US and European countries, which

requires suppliers to adhere to strict compliance requirements, leading to a high

regulatory gestation period; and (b) the involvement of complex chemistries in the

manufacturing process, which is difficult to commercialize on a large scale.

Key Risks & Concerns

Risk related to volatile raw material prices and foreign exchange rates - Raw material cost remains the major cost component for the company. This exposes the company to any sharp volatility in raw material prices. In export sales, AOL witnesses price revision on a quarterly basis considering the prices of the key starting material (KSM) and forex rates, while the domestic sale is on a spot basis. This mitigates the price volatility risk to a certain extent.

Inherent regulatory risk - AOL is exposed to regulatory risk, since the players in the pharmaceuticals industry need to manufacture products that meet the set quality standards of various regulators across the globe as well as the customer requirements. Furthermore, the pharmaceuticals industry is highly regulated and requires various approvals, licenses, registrations, and permissions for business activities.

Competitive nature of industry – The Company operates in a competitive environment and failure to compete effectively may have a bearing on the company’s financial performance.

Outlook & Valuation

AOL reported healthy earnings growth for the quarter ended Q2FY25. We like AOL given its wide product portfolio in pharmaceutical intermediates, diversification efforts into other specialty chemical spaces, strong clients relation across geographies, and robust financials. It is well placed to tap opportunity in the fast-growing specialty chemical market by leveraging its strong R&D and expanding product portfolio. We believe that the near to medium term growth would be driven by advanced intermediates for pharma innovators. The management has revised the revenue growth guidance for FY25 from 25% to 30% based on the company’s order book. What we like most is the earlier-than-expected ramp-up of CDMO supplies in 2QFY25, the full ramp-up expected in the future. This is expected to be driven by the ramp-up in CDMO supplies. The company is gradually executing Fermion’s contract in the first block of the Ankleshwar unit. It is meant for advanced pharmaceutical intermediates for the API Darolutamide and would finally ramp up in FY26. We believe Ami Organics is well-placed to capitalize on domestic and global opportunities.