The right place for growth-minded investors

Introducing MILARS® – Our proven way to find growth stocks backed by quality businesses.

Learn MILARS®

Number of client's complaints - RA

Data of the month ending September, 2025

| Received from | Pending at the end of last month | Received | Resolved * | Total pending # | Pending complaints > 3 months | Average resolution time ⌃(in days) |

|---|---|---|---|---|---|---|

| Directly from investor | Nil | Nil | N.A | Nil | Nil | N.A |

| SEBI (SCORES) | Nil | Nil | N.A | Nil | Nil | N.A |

| Other Sources (if any) | Nil | Nil | N.A | Nil | Nil | N.A |

| Grand Total | Nil | Nil | N.A | Nil | Nil | N.A |

A successful investment approach

MMarket

Direction

Why MILARS®?

Proven strategy

MILARS® (Market direction, Industries & sectors, Leading stocks, Acceleration in earnings, Relative price strength, Selling Rules) is our comprehensive approach to stock selection.

Consistent performance

stockaxis flagship's MILARS® strategy has a track record of delivering robust performance.

Predefined selling rules

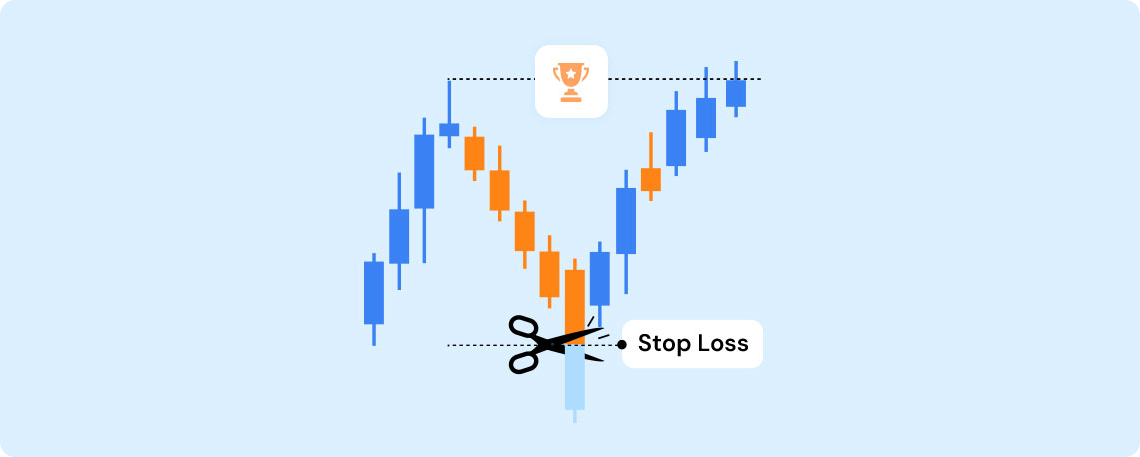

We understand the importance of timing when it comes to optimizing profits. That's why we follow predefined selling rules, including cutting losses short and letting winners run.

Active tracking

At stockaxis, our work doesn't stop at the initial recommendation. Our team actively monitors the recommended stocks, including price movements, financial performance, and company updates.

4 Smart ways to grow your wealth

Little masters Small Caps. Big Fundamentals. Built for Long-Term Compounding.

Receive fundamentally strong small-cap stocks with the potential to become tomorrow’s industry leaders. We use our proprietary MILARS® Strategy to identify businesses with clean balance sheets, visionary management, and scalable growth potential.

- Fast-growing sectors

- Scalable business models

- New ideas and businesses

- Strong financial filters

Backed by the MILARS® Framework – A 6-step approach to smart investing.

Learn more

Emerging Leaders Mid-Cap Growth Stocks Backed by Research & Vision

Our analysts use the MILARS® Strategy to identify mid-cap companies gaining traction — firms with accelerating earnings, rising relative strength, and industry leadership.

- Good mix of growth and safety

- Rising industry leaders

- Strong earnings visibility

- Steady growth

MILARS® helps you stay focused on companies that are not just growing, but leading.

Learn more

Large cap focus Reliable Giants with Strength, Stability & Steady Upside.

We shortlist large-cap stocks with strong financial discipline, high return ratios, and governance quality through a disciplined MILARS® lens.

- Stable returns

- Well-managed companies

- Better liquidity

- Dividend income

MILARS® filters help avoid emotional investing and chase real value.

Learn more

Stocks on the move Short-Term Trends. Backed by Research. Managed with Discipline.

Capture momentum in fundamentally sound stocks with a technical edge. This service is designed for active investors seeking to capitalize on short-term opportunities (2–8 weeks) while adhering to predefined entry, exit, and stop-loss rules.

- Short-term opportunities

- Capture price breakouts

- Benefit from momentum

- Stop-loss discipline

Level up your whole investing experience

Get timely

alerts

Never miss an opportunity with our real-time recommendation alerts via WhatsApp, e-mails and mobile app notifications.

Exceptional client

support

Our dedicated support team is here to assist you every step of the way, ensuring a seamless experience.

Access on

the go

Access our recommended stocks effortlessly through our user-friendly web login and mobile app.

Entry & exit

guidance

Stay informed with alerts for both buying and selling, as our team diligently tracks open positions.

Key Statistics

Total Recommendations

Total Reco.

Open

Closed

Average Holding Duration (Months)

Total Duration

Open

Closed

Industry-Wise Breakdown

Successful Investors Follow

These Principles

Successful investing is not just about luck or timing – it's about

following timeless principles.

Invest in Growing Companies:

Invest in businesses with strong potential for long-term growth.

Invest for the Long Term:

Resist the temptation of short-term gains and focus on sustainable growth over time.

Magic of Compounding:

Let time work in your favor by allowing your returns to generate returns.